What is it like if your fund not only doesn't rise but actually falls during a market upturn?

Looking back at the significant market upturn since September 24th, whether it's individual stocks or funds, the competition is about the magnitude of the increase. However, the reporter noticed that as of October 10th, some funds have actually fallen, with some even experiencing a drop exceeding 10%.

What exactly is going on?

Market surges, funds drop over 10%

Starting from the upturn on September 24th, by October 10th, the Shanghai Composite Index had risen by more than 20%, and the ChiNext and STAR Market indices had increased by more than 40%.

However, the reporter observed that some funds had negative returns during the same period. Wind data shows that by selecting mixed stock funds, passive index funds, flexible allocation funds, and ordinary stock funds, it can be seen that between September 24th and October 10th, 25 funds had a drop of more than 1%, with some even experiencing a drop of more than 10%.

The most typical example is the Dacheng Leading Power Mixed Fund, which saw a drop of over 10% during the aforementioned period.

According to the information, the fund was established on August 28th of this year with an establishment scale of about 255 million yuan. Looking at the establishment timeline, the fund was essentially established on the eve of the surge and had ample time to build positions. If it could have built positions in a timely manner, it would have seized the "golden opportunity."

However, the reality is that since its establishment, the net value of the fund has not fluctuated much. The net value of Class A shares was 1.0011 yuan on September 27th, 1.0022 yuan on September 30th, and still 1.0021 yuan on October 8th.

From the amplitude of the net value fluctuations, it can be seen that the fund has maintained a low stock position from its establishment until before October 8th.By October 9th, the net value of Class A shares of the fund had dropped by 6.04%, and on October 10th, the net value fell by another 5.41%, reaching 0.8907 yuan. This means that in just two short days, the decline exceeded 10%.

Clearly, the fund manager only increased the position after October 8th, and then the market adjusted, causing the net value to retract. In other words, the fund manager maintained a low position in the bottom area and did not follow up in time when the market rose. After the market continued to rise significantly, they bought at a high price. This common action among retail investors appeared among professional fund managers.

It is worth noting that the fund opened for daily subscriptions, redemptions, conversions, and fixed investments starting from October 8th. Some industry insiders analyzed and pointed out: "The fund manager may have considered that some funds needed to exit, so they waited until it was open before starting to buy. However, from the timing, there is indeed a bit of an operational issue."

Old products also bought at high prices

It is worth noting that if this fund is a newly established product and the fund manager is more cautious in building the position, then looking at another product managed by the fund manager - the Dacheng National Security Theme Fund, a similar situation has also occurred.

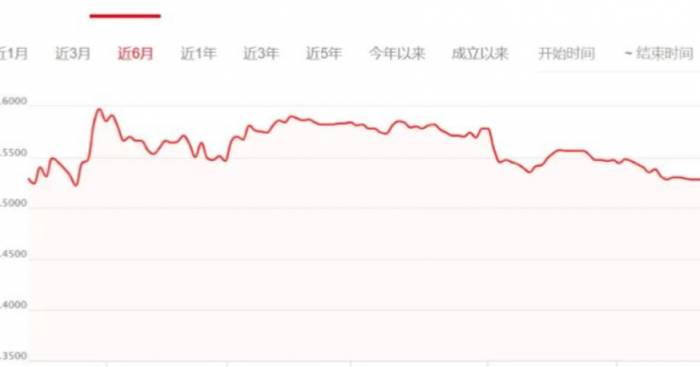

The fund was established on May 4, 2016, with a history of more than 8 years. Fund manager Wang Shuai started to manage the fund jointly with Wei Qingguo on September 27, 2023, and has been managing the fund alone since October 10, 2023.

As a flexible allocation product, the stock position can be as low as 0. Wang Shuai made a significant reduction in the second quarter of this year. It can be seen from the fund's quarterly report that as of the end of the first quarter of this year, the stock position accounted for 31.97% of the fund's total assets, and by the end of the second quarter, the stock position accounted for only 0.97% of the fund's total assets.

Although the reduction in the second quarter significantly reduced the fund's volatility and to some extent avoided market adjustments, by the end of the third quarter, when the market began to continue to rise, the net value growth of the fund was 0 for many trading days.

Obviously, the fund did not build a position in time, and on October 8th, Class A shares of the fund fell by 1.44%, 6.30% on October 9th, and another 2.48% on October 10th.From the perspective of net value performance, it is very similar to the Dacheng Leading Power Mixed Fund, with a significant decline in net value on October 9th and October 10th. This was obviously due to buying high after October 8th, and the result was also buying at a high point of the phase.

It is worth mentioning that many flexible allocation funds have appeared on the above list of declines, many of which were due to a low position before, and then buying high, which led to a significant drawdown.

ETF did not build a position in time and was forced to buy high

In addition to these two funds, from the above table, there are also many funds that did not build a position in time, and then bought later, causing the market to rise while the fund's net value fell.

For example, the Wanjia China Securities All-Share Public Utilities ETF has also attracted a lot of attention from investors recently. The information shows that the ETF was established on September 11, 2024, and from the establishment point of view, it also belongs to the "golden time".

Moreover, as a passive index product, it does not require the fund manager to make too many timing choices. However, according to the listing announcement, as of September 25, 2024, the proportion of the fund's stock position to the total assets of the fund was only 11.9%.

By September 30, the net value of the fund had only increased by 1.40%, while the increase in the China Securities All-Share Public Utilities Index on the same day was 6.47%. The fund's increase was significantly behind the index's increase, and it was obvious that the fund manager had not increased the position in time at this point.

It is worth noting that the trading day of the fund was October 9, which means that the fund manager had to increase the position to the specified proportion before October 9. The fund manager could only buy high, and as a result, the market fell back on October 8, and the net value of the fund fell by 2.39% on that day, and fell by 5.24% on October 9.

In general, this round of increases exceeded the expectations of many investors, and many funds missed the increase because they did not keep up in time, including the previously disclosed multiple China Securities A500 ETFs.

However, as professional investors, especially when there is ample time to build a position, and especially for index products that do not require too much timing, it is still not in line with the professional image to delay building a position and finally have to buy high.

post your comment